Assuming no change in product demand a pure monopolist – Assuming no change in product demand, a pure monopolist wields immense market power. This captivating exploration delves into the intricate world of pure monopolies, examining their characteristics, pricing strategies, and the welfare implications they pose. Prepare to unravel the complexities of this market structure and its profound impact on consumers, producers, and the economy as a whole.

In a pure monopoly, a single entity reigns supreme, controlling the entire market for a particular good or service. This dominance grants the monopolist the ability to set prices above marginal cost, leading to potential welfare losses and market inefficiencies.

Market Structure

A pure monopoly is a market structure characterized by a single seller who controls the entire supply of a product or service. Pure monopolies are rare in practice, but they can arise in certain industries due to factors such as economies of scale, patents, or government regulations.

Barriers to Entry

- Economies of scale:When the cost of producing a good or service decreases as the scale of production increases, it can create barriers to entry for new firms.

- Patents:Patents grant exclusive rights to inventors, giving them the sole power to produce and sell their inventions for a certain period of time.

- Government regulations:Governments can create barriers to entry through licensing requirements, quotas, or other regulations that restrict competition.

Demand and Revenue

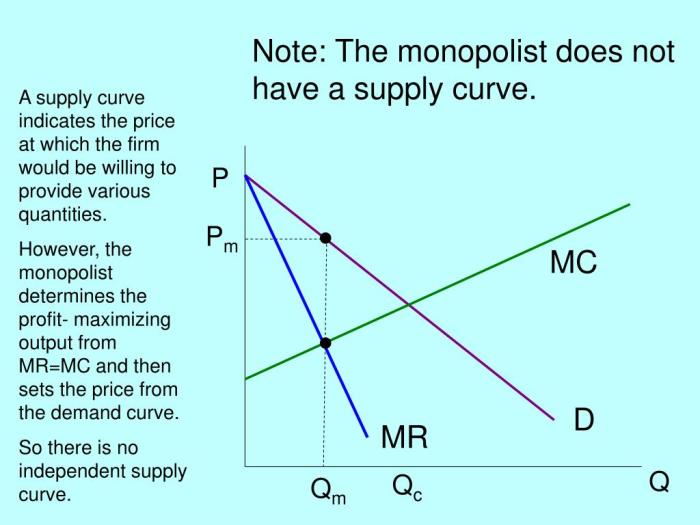

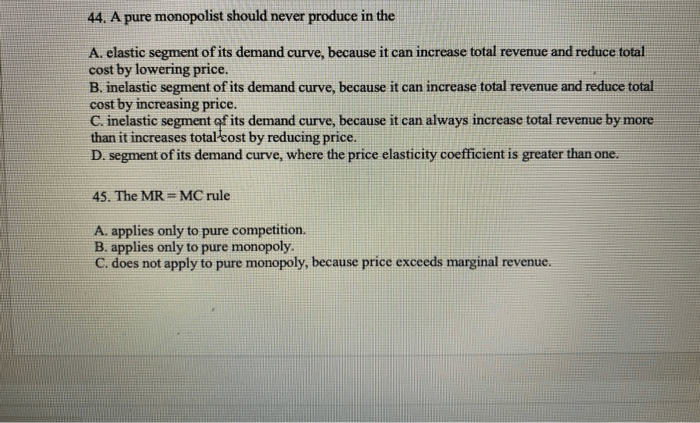

In a pure monopoly, the monopolist has complete control over the price and quantity of the product or service. The demand curve for a monopolist is downward sloping, indicating that as the price increases, the quantity demanded decreases. However, unlike in perfect competition, the monopolist’s marginal revenue curve (MR) is below its average revenue curve (AR).

Marginal Revenue vs. Average Revenue

Marginal revenue (MR) is the change in total revenue resulting from the sale of one additional unit of output. Average revenue (AR) is the total revenue divided by the quantity of output sold. In a monopoly, MR is less than AR because as the monopolist increases output, it must lower the price to sell the additional units, reducing the revenue per unit sold.

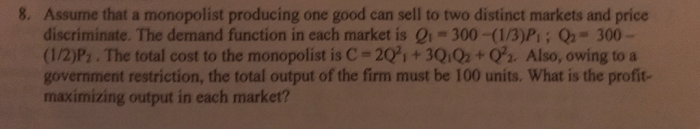

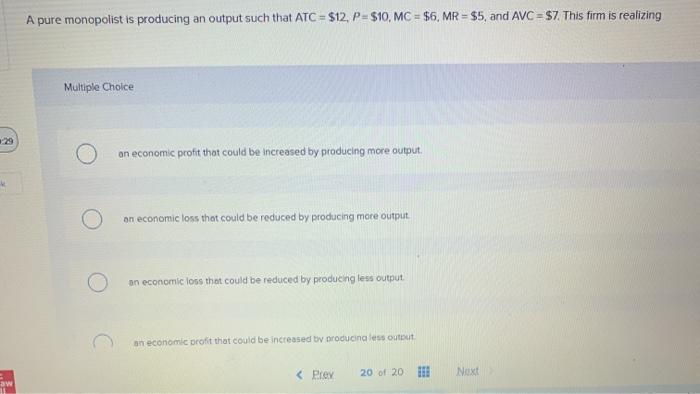

Profit Maximization: Assuming No Change In Product Demand A Pure Monopolist

A pure monopolist’s goal is to maximize profits. The profit-maximizing quantity is where MR = MC (marginal cost). At this quantity, the monopolist will set a price that maximizes the difference between total revenue and total cost.

Price Discrimination

Price discrimination is a strategy used by monopolists to increase profits by charging different prices for the same product or service to different customers. This can be done based on factors such as location, age, or income level.

Welfare Implications

Pure monopolies can have negative welfare implications. The monopolist’s ability to set prices above marginal cost can lead to deadweight loss, which is a loss of consumer and producer surplus. Additionally, monopolies can stifle innovation and competition, as new firms may be discouraged from entering the market.

Efficiency Comparison, Assuming no change in product demand a pure monopolist

Compared to a perfectly competitive market, a pure monopoly is less efficient. In perfect competition, firms produce at the point where P = MC, which is the most efficient outcome for society. In contrast, a monopolist produces at the point where MR = MC, which results in a higher price and lower quantity produced than in perfect competition.

Government Intervention

Governments may intervene in pure monopolies to protect consumer welfare and promote competition. Justifications for government intervention include:

- Market failure:Monopolies can lead to market failures such as deadweight loss and reduced innovation.

- Natural monopolies:Some industries, such as utilities, have natural monopolies due to economies of scale. Government intervention may be necessary to regulate these industries and prevent abuse of market power.

Types of Government Policies

- Antitrust laws:These laws prohibit anti-competitive practices such as price fixing, mergers that reduce competition, and predatory pricing.

- Regulation:Governments can regulate monopolies by setting price controls, limiting entry into the market, or requiring the monopolist to provide certain services.

- Public ownership:In some cases, governments may choose to own and operate natural monopolies to ensure fair prices and access to essential services.

Answers to Common Questions

What are the defining characteristics of a pure monopoly?

A pure monopoly is characterized by a single seller dominating the entire market for a particular good or service, with no close substitutes available.

How does a monopolist determine its optimal price?

A monopolist sets its price above marginal cost, where marginal revenue equals marginal cost, to maximize profits.

What are the potential welfare losses associated with pure monopolies?

Pure monopolies can lead to deadweight loss, where consumers are willing to pay more for a good than the monopolist’s marginal cost, resulting in underproduction and reduced consumer surplus.