Firms that compile financial statements according to gaap: – Firms that compile financial statements according to Generally Accepted Accounting Principles (GAAP) play a pivotal role in ensuring the reliability and credibility of financial reporting. Their adherence to GAAP standards fosters transparency, accuracy, and comparability in financial statements, which are essential for informed decision-making by investors, creditors, and other stakeholders.

The diverse landscape of firms compiling GAAP-compliant financial statements offers a range of services tailored to the specific needs of businesses. From small accounting firms to large multinational corporations, these firms provide expertise in GAAP compliance, helping companies navigate the complexities of financial reporting regulations.

1. Firms that Compile Financial Statements According to GAAP

Firms that compile financial statements according to Generally Accepted Accounting Principles (GAAP) play a crucial role in ensuring the accuracy and reliability of financial information reported by companies.

GAAP compliance is essential for financial reporting as it provides a standardized framework for the preparation and presentation of financial statements. This framework ensures that financial statements are consistent, transparent, and comparable across different companies and industries.

2. Types of Firms that Compile Financial Statements

Public Accounting Firms

Public accounting firms are independent firms that provide a range of accounting services, including financial statement compilation. These firms are registered with the Securities and Exchange Commission (SEC) and are subject to strict quality control standards.

Private Accounting Firms

Private accounting firms are not registered with the SEC and provide accounting services to non-public companies. They may specialize in specific industries or offer a broader range of services.

In-House Accounting Departments, Firms that compile financial statements according to gaap:

Some companies have in-house accounting departments that compile their own financial statements. These departments are typically staffed by certified public accountants (CPAs) and are subject to internal controls and audit procedures.

3. Qualifications and Standards for Compiling Financial Statements: Firms That Compile Financial Statements According To Gaap:

Firms that compile financial statements must meet certain qualifications and adhere to professional standards.

Professional Ethics and Independence

Firms must maintain professional ethics and independence to ensure the objectivity and reliability of their work. They must avoid conflicts of interest and maintain confidentiality.

Regulatory Framework

The compilation of financial statements is governed by various regulatory frameworks, including the SEC, the Public Company Accounting Oversight Board (PCAOB), and state accounting boards.

4. Process of Compiling Financial Statements

The process of compiling financial statements involves the following steps:

- Gathering and reviewing source documents

- Applying accounting principles and standards

- Preparing financial statements

- Issuing a compilation report

Challenges and considerations during the compilation process include:

- Data availability and accuracy

- Interpretation of accounting standards

- Timeliness and efficiency

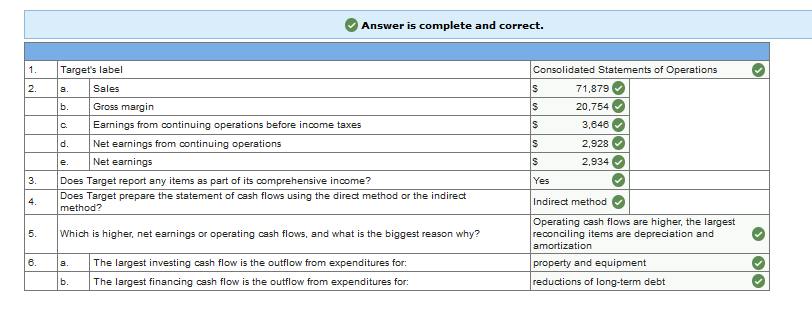

5. Reporting and Disclosure Requirements

Firms that compile financial statements are responsible for ensuring accurate and transparent financial reporting.

They must comply with reporting standards, such as the International Financial Reporting Standards (IFRS) and the SEC’s Regulation S-X.

Non-compliance with reporting standards can result in penalties and reputational damage.

6. Trends and Developments in GAAP Compliance

GAAP compliance is constantly evolving to keep pace with changing business practices and regulatory requirements.

Emerging technologies, such as blockchain and artificial intelligence, are impacting the way financial statements are compiled and reported.

Firms must stay up-to-date with these trends to ensure that their services remain relevant and valuable.

FAQ

What are the benefits of using firms that compile GAAP-compliant financial statements?

Firms that compile GAAP-compliant financial statements provide assurance that the financial information presented is accurate, reliable, and comparable. This enhances the credibility of the financial statements and facilitates informed decision-making by stakeholders.

What types of firms can compile GAAP-compliant financial statements?

Various types of firms can compile GAAP-compliant financial statements, including public accounting firms, private accounting firms, and internal accounting departments within companies. Each type of firm offers a unique set of services and expertise tailored to the specific needs of their clients.

What are the key considerations when choosing a firm to compile GAAP-compliant financial statements?

When selecting a firm to compile GAAP-compliant financial statements, it is important to consider the firm’s reputation, experience in GAAP compliance, fees, and ability to meet the specific needs of the organization.